This post was originally published here (Urban Wire)

If the media reports are any indication, interest in donor-advised funds (DAFs) is on the rise. DAFs enable donors to claim a tax deduction by placing their donation in a fund run by a charity, which will later be distributed, under the advice of “donor advisers,” to other Internal Revenue Service–registered charities.

Recent headlines imply that DAFs reduced money distributed for charitable purposes, but that is misleading, if not wrong. In fact, because of additional investment gains that must be distributed and low overhead costs relative to other forms of endowed giving, DAFs tend to increase what charities receive over time. And by offering new, creative ways of giving, DAFs may increase taxpayer contributions as well.

But some still say that the money put into these and other forms of endowment should be spent more quickly, though payouts from DAFs now approximate contributions to them. So what are the real issues with DAFs?

Why some donors like DAFs

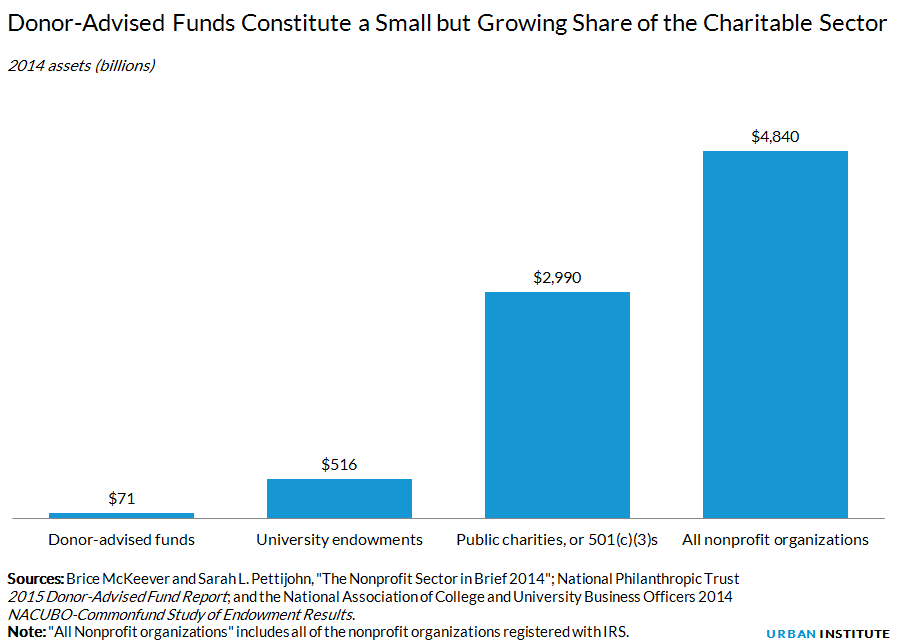

Community foundations have offered DAFs for decades, but more recently have been joined by national providers, the largest of which are Fidelity Charitable, Vanguard Charitable, and Schwab Charitable. Assets of DAFs totaled $70.7 billion in 2014, increasing from $33.6 billion in 2010.

Though DAFs are small compared with the charitable sector’s $5 trillion in assets and moderate in size compared with private foundation and university endowments, they are growing quickly in popularity among donors. Unlike many forms of asset and endowment holdings, including land, buildings, artwork, and private foundation assets, DAFs are efficient, flexible, adaptable, and carry low administrative costs.

As an added bonus, they allow donors to put the money aside in a charity, take a deduction, and decide later how to allocate that money.

To supporters, DAFs offer a unique opportunity to expand charitable giving. By granting middle-wealth donors the ability to endow their giving without establishing a foundation or separate charity (adding considerable administrative costs), DAF providers support a “democratization of giving.” DAFs can help donors save for a big-ticket donation down the road, such as building a new hospital wing or building the capacity of a small nonprofit. They are also popular among parents and grandparents who wish to pass down philanthropic values to the next generation.

To opponents, DAFs’ growing size makes them a target for suspicion and raises questions about whether the funds will increase net contributions. Some opponents object to endowments more generally. Some criticize the national DAF providers because, though set up as separate charities, they were created by commercial firms and tend to hold assets in financial platforms offered by those firms.

Learn More: